SAP Treasury and Risk Management

- 4-5 weeks

- 62 Hours

- 3400+ Student Enrolled

Live Instructor Online Training

Learn From SAP Experts

- Certified SAP Experts for more than 10+ years.

SAP TRM Online Training

Have Queries? Ask our Experts

+91 9922848898

Course Overview

Step into the world of financial proficiency with our SAP Treasury and Risk Management (SAP TRM) Online Training. Our thorough SAP TRM Module Training is designed to provide you the information and abilities required to successfully manage every aspect of treasury operations.

Why take our SAP TRM Online Training? We provide a dynamic learning environment that blends conceptual understanding with real-world applications to give you a practical grasp of SAP TRM features. Invest in your future by taking advantage of our SAP Treasury and Risk Management Online Training, where knowledge meets creativity and education leads to professional development.

SAP TRM (Treasury and Risk Management) is a SAP application module that assists a company's finance department in analysing and optimising business processes in terms of financial assets, cash flows and risks. In simple terms, improves financial resource management and risk reduction for enterprises. Sap Treasury Module provides tools for managing financial risks such as foreign exchange (FX) exposure, interest rate risks, and commodity risks. It also supports money market transactions, foreign exchange derivatives, and security management, enabling organizations to handle various financial instruments and securities efficiently.

In Technical terms: A potent software program SAP Treasury and Risk administration (TRM) unites several aspects of financial administration into a single, centralized platform.TRM connects with other SAP modules or sap treasury modules and external systems creating a unified approach to managing finances. TRM consists of several modules that cover various aspects of treasury operations such as handling cash and liquidity, managing debts and investments, dealing with foreign currencies and derivatives and addressing risks. By using Sap treasury module, organizations can automate workflows and approval processes, making treasury operations more efficient and streamlined. TRM ensures that all financial data is up-to-date and accurate, enabling organizations to make informed decisions based on real-time information.

.webp)

1.Market Data Integration: SAP TRM provides integration capabilities to fetch real-time market data from various sources. This feature allows users to access up-to-date market rates, prices and indices for accurate valuation and risk assessment.

2.Derivatives and Options Management: SAP TRM supports the management of derivatives and options contracts. Users can perform trade capture, valuation and risk analysis of complex financial instruments.

3.Cash Flow Forecasting: SAP TRM offers cash flow forecasting capabilities that allow organizations to project their future cash flows based on historical data, trends and predictive algorithms. This feature assists in optimizing cash planning and identifying potential cash shortages or surpluses.

4.Credit Risk Management: It includes functionalities to assess and monitor counterparty credit exposures. It enables credit limit monitoring, credit risk scoring, credit risk analysis and collateral management.

5.Treasury Analytics and Reporting: SAP TRM offers robust analytics and reporting capabilities to provide insights into treasury operations. Users can generate customizable reports, perform ad-hoc analysis and visualize key performance indicators (KPIs) through dashboards, enabling better decision-making and performance monitoring.

6.Treasury Workflow and Automation: SAP TRM supports workflow automation to streamline treasury processes. It enables the creation of approval workflows for various treasury activities, such as cash management, payment approvals, risk mitigation and financial instrument management improving operational efficiency.

7.Audit and Compliance Trail: SAP TRM module or sap treasury module maintains an audit trail and comprehensive transaction history, ensuring transparency and accountability. It records user actions, system activities and changes made to financial data, supporting internal and external audits.

1.Cash and Liquidity Management: Cash and Liquidity Management in SAP TRM involves the optimization and monitoring of cash positions and liquidity requirements. It provides features for cash forecasting, cash pooling, cash positioning and bank account management. Organizations can gain real-time visibility into their cash positions, streamline cash operations and effectively manage their liquidity to meet financial obligations and optimize cash utilization.

2.Risk Management: The Risk Management functionality helps organizations identify, analyze and manage financial risks. Users can perform risk assessments, utilize risk analytics and implement risk mitigation strategies. SAP TRM provides tools for measuring risk exposures, stress testing, value at risk (VaR) calculations and credit limit management enabling organizations to make informed decisions and proactively manage risks.

3.Debt and Investment Management: Enables organizations to manage their debt and investment portfolios effectively. It includes features for debt issuance, debt lifecycle management, investment planning and investment analysis. Organizations can monitor debt positions, track debt maturity profiles, perform scenario analysis and evaluate investment options. SAP TRM supports the management of various debt instruments and investment vehicles allowing organizations to optimize their debt and investment strategies.

4.Hedge Management: It assists organizations in managing their exposure to market risks such as foreign exchange and interest rate risks. It provides tools for hedge accounting, hedge effectiveness testing and hedge documentation. Organizations can define and execute hedging strategies, assess hedge performance and comply with accounting standards. SAP TRM streamlines the process of managing and monitoring hedging activities ensuring accurate risk hedging and financial reporting.

5.Treasury Operations and Compliance: This functionality focuses on streamlining treasury operations and ensuring compliance with regulatory requirements. It covers areas such as transaction management, trade processing, treasury accounting and regulatory reporting. SAP TRM automates the generation of accounting entries, facilitates straight-through processing and helps organizations meet compliance obligations. It supports treasury-specific reporting requirements, regulatory frameworks and accounting standards, enhancing operational efficiency and compliance.

There are several other Non-SAP TRM Solutions available in market, such as Kyriba, gtreasury, Trovata, Reval etc. While these solutions offer some benefits they still fall short when compared to SAP TRM.

For instance, Kyriba offers a comprehensive cash and liquidity management solution but Some users have reported a steep learning curve when using Kyriba due to its complex functionality. Similarly, gtreasury provides robust risk management capabilities but has been criticized by some users for being less intuitive compared to other solutions. Trovata offers automated bank data integration, but functionality may be limited especially for larger organizations with complex needs. Reval provides advanced treasury analytics and forecasting capabilities but it is time-consuming and resource-intensive.

Here's a comparison between SAP TRM (Treasury and Risk Management) from other non-SAP TRM solutions:

| Aspect | SAP TRM | Other TRM Solution |

|---|---|---|

| Integration with SAP ERP | Deep integration | Limited integration or no integration |

| Functionality breadth | Comprehensive functionality | Varied functionality, may be limited |

| Scalability | Scalable to support large organizations | Scalability varies, may not support as large scale |

| Industry Focus | Wide range of industries | Varies by solution and provider |

| User Experience | Familiar SAP interface | User experience varies |

| Total Cost of Ownership | Cost may vary based on modules implemented | Cost vary based on provider and features |

In the financial world, the money market is essential because it offers a venue for short-term borrowing and lending of money.

Treasury bills, commercial papers, and certificates of deposit are just a few examples of the financial instruments that are bought and sold during trading operations in the money market

.png)

These functions enable participants to manage their short-term funding needs, invest excess cash or generate returns on their investments.

Back office functions ensure smooth and efficient processing of transactions, reducing operational risks. This includes activities such as trade confirmation, settlement instruction, reconciliation and managing collateral requirements.

Accounting functions in the money market involve recording and tracking the financial transactions in an organization's books. This includes capturing trade details, valuing investments and recording interest income or expense. Accounting functions play a critical role in ensuring accurate financial reporting and compliance with accounting standards.

Special functions in the money market pertain to activities such as cash forecasting, liquidity management and risk analysis. Cash forecasting helps organizations project their future cash flows and make informed decisions regarding investment or financing needs. Liquidity management involves optimizing cash resources to meet short-term obligations while maintaining sufficient liquidity. Risk analysis assesses and manages various risks associated with money market transactions such as interest rate risk or counterparty risk.

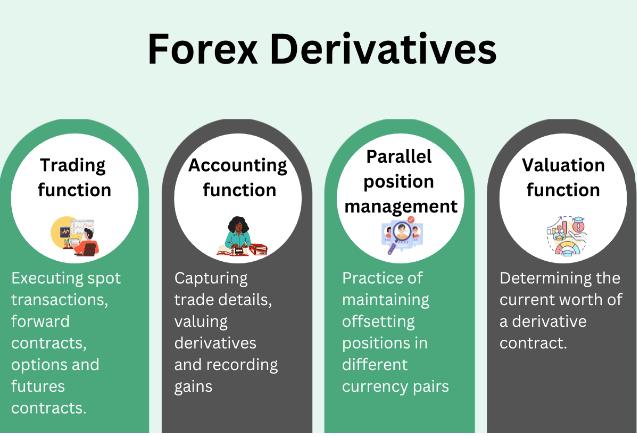

Financial instruments called forex derivatives get their value from fluctuating exchange rates. Companies and investors use them frequently to manage currency risk and make predictions about exchange rate movements. Trading in foreign exchange entails purchasing and selling currencies on a global scale.

Trading functions in forex derivatives include executing spot transactions, forward contracts, options and futures contracts.

Accounting functions in forex derivatives include capturing trade details, valuing derivatives and recording gains or losses from changes in exchange rates.

Accounting functions play a vital role in accurately reflecting the financial impact of forex derivative transactions in the financial statements.

In addition to trading and accounting functions there is an additional concept called parallel position management.

Parallel position management refers to the practice of maintaining offsetting positions in different currency pairs to hedge currency risk effectively. By holding both long and short positions in different currencies, companies can minimize their exposure to exchange rate fluctuations.

Valuation functions in forex derivatives include determining the current worth of a derivative contract based on market factors including the underlying exchange rate, time to expiration, interest rates and volatility. Accurate valuation is crucial for financial reporting and assessing the overall financial health of an organization.

.png)

Security management involves the comprehensive management of financial securities such as stocks, bonds and other investment instruments. It encompasses various processes and functions to ensure the effective and secure handling of these assets.

Master data management is a crucial aspect of security management. It involves creating and maintaining accurate and up-to-date information about securities, including details such as security types, issuers, maturity dates, interest rates and ratings. Master data serves as the foundation for all subsequent activities related to securities.

Trading and back-office functions are integral to security management. Trading functions involve buying and selling securities in the financial markets. This includes activities such as order placement, execution, and trade confirmation. Back-office functions handle the processing and settlement of trades, including activities like trade reconciliation, documentation and collateral management.

Accounting and closing operations play a vital role in security management. Accounting functions involve recording and tracking the financial transactions related to securities. This includes valuing securities, recording interest income or expense, and recognizing gains or losses from changes in market value. Closing operations involve reconciling positions, calculating net asset values, and generating financial reports.

Position management is another important aspect of security management. It involves monitoring and controlling the positions held in various securities. This includes tracking the quantity, valuation, and performance of securities within an investment portfolio. Effective position management allows organizations to assess risk exposures, evaluate performance, and make informed investment decisions.

The Market Risk Analyzer is a tool used in financial risk management to assess and analyze market risks associated with financial instruments and portfolios. It provides an overview of market risk exposures and helps organizations make informed decisions regarding risk mitigation strategies.

Price parameters play a crucial role in the Market Risk Analyzer. These parameters define the factors that affect the prices of financial instruments such as interest rates, foreign exchange rates and commodity prices. By setting accurate price parameters, organizations can simulate and analyze the impact of market movements on their portfolios. Analysis structures and basic settings are essential components of the Market Risk Analyzer.

Net Present Value (NPV)/Sensitivity analysis is a key feature of the Market Risk Analyzer. It calculates the NPV of a portfolio or position and analyzes its sensitivity to changes in market factors. This analysis helps organizations understand how variations in market parameters affect the profitability and value of their investments.

Value at Risk (VaR) analysis is another important aspect of the Market Risk Analyzer. VaR measures the potential loss of a portfolio or position within a specified time horizon and at a given confidence level. It provides organizations with an estimate of the maximum potential loss they may incur under normal market conditions helping them assess and manage their risk exposure effectively.

The Credit Risk Analyzer is a tool used in financial risk management to assess and analyze credit risks associated with borrowers and counterparties. It provides valuable insights into the creditworthiness of individuals, companies or other entities helping organizations make informed decisions regarding credit exposures.

The concept of Credit Risk Analyzer revolves around evaluating the likelihood of default or non-payment by borrowers. It examines various factors such as credit ratings, financial statements, payment history, and market conditions to gauge the creditworthiness of borrowers. By utilizing this tool, organizations can assess the level of risk associated with extending credit to different entities.

Basic configuration knowledge is essential in setting up the Credit Risk Analyzer. It involves configuring parameters and settings to align with the organization's credit risk management policies and practices. This includes defining credit risk limits, credit scoring models, and risk assessment methodologies. The basic configuration ensures that the Credit Risk Analyzer is tailored to the specific needs and requirements of the organization.

In summary, the Credit Risk Analyzer is a tool that assists organizations in assessing and managing credit risks. It analyzes various factors to evaluate the creditworthiness of borrowers and counterparties. Basic configuration knowledge is crucial in setting up the tool according to the organization's credit risk management policies. By leveraging the capabilities of the Credit Risk Analyzer, organizations can make informed credit decisions and effectively manage their credit risk exposure.

Are you prepared to advance your level of financial knowledge? Take advantage of your chance to learn about SAP Treasury and Risk Management (SAP TRM) in-depth with our extensive SAP TRM online training. Give yourself the knowledge and abilities necessary to confidently manage the SAP TRM module's details.

Join our SAP TRM Online Training today and unlock a world of possibilities. You can enroll with us whether you're an experienced financial expert or a SAP FICO consultant. Advance your profession, help your company succeed, and become a SAP TRM expert. Your journey to financial excellence starts here!

Online Corporate Training Course

- Curriculum aligned with latest industry trends

- Experienced and certified trainers

- Real-life scenarios

- Lifetime access to course material (pdfs, ppts and videos)

Recorded Video Online Training

- Updated course content

- Lifetime access to course content (videos and materials)

- Flexibility to learn anytime, anywhere

Instructor-Led Online Training

- Candidate pre-evaluation

- Certified and experienced trainers

- Email support and online query resolution

- 24/7 access to SAP Sandbox

Free Demo session

SAP TRM (Treasury and Risk Management) is a module within the SAP ERP system that provides comprehensive tools and functionalities for managing treasury operations, including cash management, liquidity planning, risk analysis and financial instrument management.

To access recorded videos of SAP TRM you can directly contact on the provided no 8379811100.

SAP TRM is used for managing treasury operations in organizations. It helps businesses optimize cash management, liquidity planning, risk analysis and financial instrument management, enabling efficient and effective management of financial resources and mitigating risks.

The benefits of SAP TRM include improved cash management, enhanced risk analysis and mitigation, streamlined financial instrument management, accurate liquidity planning, increased operational efficiency and better visibility and control over treasury operations, leading to better financial decision-making and overall financial performance.

The eligibility criteria for the SAP TRM Certification Course is it requires a basic understanding of finance and treasury management concepts. Some courses may also have prerequisites such as prior experience in SAP ERP or completion of related SAP treasury module.